SCHEDULE OF SPECIAL TAXPAYERS AND WITHHOLDING AGENTS FOR YEAR 2023

Administrative Ruling No. SNAT/2022/000068, dated November 8, 2022, issued by the Superintendent of the National Integrated Service of Customs and Tax Administration (SENIAT), was published in Official Gazette No. 42.515 of November 29, 2022 (the Ruling). The Ruling established the schedule of Special Taxpayers and Withholding Agents for the obligations to be performed for year 2023.

The declarations of Value Added Tax (VAT) and Income Tax (IT), including the advances on the same, Tax on Activities of Games of Chance, Tax on Large Patrimonies (TLP), and Tax on Large Financial Transactions (TLFT), as well as the delivery of the IT and VAT amounts withheld by the Withholding Agents and the contribution of 70% of the revenues of Deconcentrated Services or Autonomous Services and Decentralized Entities, must be filed as per the last digit of the Fiscal Information Registry (RIF) number on the due dates of the 2023 schedule published in the Ruling.

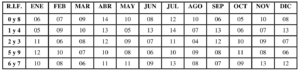

The special taxpayers that carry out mining or hydrocarbon and connected activities, such as refining and transportation, and do not receive royalties derived from said operations must file the declarations and make the relevant VAT payments on a monthly basis, as per the last digit of the RIF number on the due dates of the 2023 schedule published in the Ruling.

The taxpayers that carry out exclusively exempt or exonerated activities must file the informative VAT declaration on a quarterly basis, as per the last digit of the RIF number, on the due dates of the 2023 schedule published in the Ruling. The quarterly VAT declaration will generate IT advances for said special taxpayers, which advances are to be paid on the date stated in the relevant payment commitment.

The declarations corresponding to the annual IT self-assessment for legal and natural persons, in the fiscal years other than that from 01/01/2022 to 12/31/2022, must be filed and paid up to the due date established in the Ruling; by virtue of the foregoing, a natural person, as special taxpayer, must file the second portion 20 calendar days after the end of the period of time established in the Ruling and the third portion, 40 calendar days after the end of the period of time established in the Ruling.

The special taxpayers that carry out mining or hydrocarbon and connected activities, such as refining and transportation, and receive royalties derived from said operations or receive income from the exportation of minerals, hydrocarbons or their derivatives must file the estimated income declaration within the first 45 calendar days after the end of the fiscal year.

The taxpayers that perform economic activities other than exploitation of mines, hydrocarbons, and connected activities and do not receive royalties derived from said operations must declare and pay the advances on IT and VAT as per the schedule established in letter a) of article 1 of the Ruling.

The declarations and payments of taxes not mentioned in the Ruling must be made on the due dates established in the legislation in force..

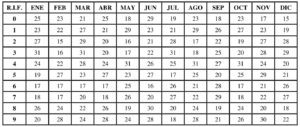

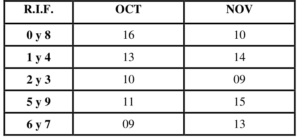

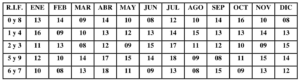

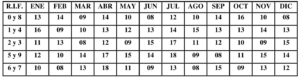

a) VAT, IT advances, TLFT, and VAT withholdings

a.1) From day 01 up to and including day 15 of each month

a.2) From day 16 up to and including the last day of each month

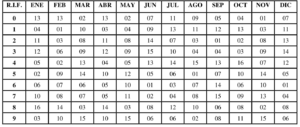

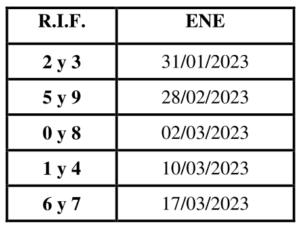

b) IT Estimated Declarations (Declaration and Payment of Portions of Regular and Irregular Years)

c) IT Withholdings

d) Activities of Games of Chance

e) IT Withholdings for lottery prizes

e.1) Made from day 01 up to and including day 15 of each month

e.2) Made from day 16 up to and including the last day of each month

f) Annual IT Self-assessment (Fiscal Year 01/01/2022 – 12/31/2022)

g) IT Self-assessment for Irregular Years

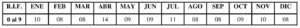

h) Tax on Large Financial Transactions

i) Declarations of contribution of 70% of the Revenues of Deconcentrated Services or Autonomous Services and Decentralized Entities

j) VAT

Failure to perform the obligations established in the Ruling will be penalized in accordance with the provisions of the Constituent Decree through which the Organic Tax Code was issued.

The Ruling became effective upon publication of the same in the Official Gazette.

In order to access the Ruling, please click here.

Should you have any question or comment or require further information, please contact the partner in charge of your account via email.